Popular Courses. Dead cats that bounce eventually return to where they bounced from. My trading methods center around one concept: capital preservation. This will indicate the gap has been filled, and the price has returned to prior resistance turned support. For more on dumpers, see last week’s column. Charting Resources. You can practice trading these three setups in Tradingsim to figure out which system fits you the best or you can work on creating your own.

Chart Signals Ratios

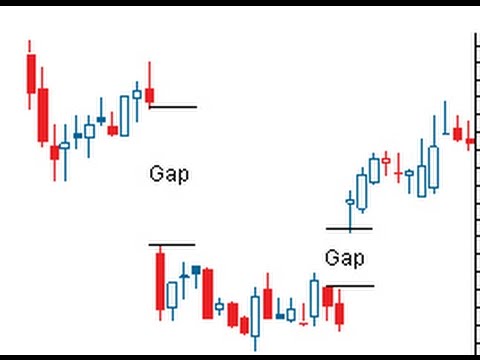

Gaps are areas on a chart where the price of a stock or another financial instrument moves sharply up or down, with little or no trading in. The enterprising trader can interpret and exploit these gaps for profit. This article will help you understand how and why gaps occur, and how you can use them to make profitable trades. Gaps occur because of underlying fundamental or technical make money on gap up stocks. For example, if a company’s earnings are much higher than expected, the company’s stock may gap up the next day. This means the stock price opened higher than it closed gp day before, thereby leaving a gap.

Attention: your browser does not have JavaScript enabled!

A Gap Up is when a stock opens at a higher level than the previous day’s high. For example, if the previous day’s high was , and the stock opened at , there would have been a 5 point gap up. This is considered a bullish signal. This is also known as a Full Gap Up as opposed to a Partial Gap Up which is when the stock just opens above the previous day’s close. Gaps are areas on a share price chart where the price of a stock moves sharply up or down, with little or no trading in between. Opening gaps can be caused by news releases for example, if a company’s earnings are much higher than expected or events that happen while the market is closed, or technical factors e. You can read more about Gap Trading Strategies here.

Instructional Videos

Gaps are areas on a chart where the price of a stock or another financial instrument moves sharply up or down, with little or no trading in. The enterprising trader can interpret and exploit these gaps for profit.

This article will help you understand how and why gaps occur, and how you can use them to make profitable trades. Gaps occur because of underlying fundamental or technical factors.

For example, if a company’s earnings are much higher than expected, the company’s stock may gap up the next day. This means the stock price opened higher than it closed the day before, thereby leaving a gap.

In the forex marketit is not uncommon for a report to generate so much buzz that it widens the bid and ask spread to a point where a significant gap can be seen. Similarly, a stock breaking a new high in the current session may open higher in the next session, thus gapping up for technical reasons.

These fills are quite common and occur because of the following:. When gaps are filled within the same trading day on which they occur, this is referred to as fading. Now let’s say, as the day progresses, people realize that the cash flow statement shows some weaknesses, so they start selling. Eventually, the price hits yesterday’s close, and the gap is filled.

Many day traders use this strategy during earnings season or at other times when irrational exuberance is at a high. Some traders will buy when fundamental or technical factors favor a gap on the next trading day. Traders might also buy or sell into highly liquid or illiquid positions at the beginning of a price movement, hoping for a good fill and a continued trend.

For example, they may buy a currency when it is gapping up very quickly on low liquidity and there is no significant resistance overhead. Some traders will fade gaps in the opposite direction once a high or low point has been determined often through other forms of technical analysis. For example, if a stock gaps up on some speculative report, experienced traders may fade the gap by shorting the stock.

Lastly, traders might buy when the price level reaches the prior support after the gap has been filled. An example of this strategy is outlined. To tie these ideas together, let’s look at a basic gap trading system developed for the forex market.

Here are the rules:. Because the forex market is a hour market it is open 24 hours a day from pm EST on Sunday until pm EST Fridaygaps in the forex market appear on a chart as large candles.

This does not look like a regular gap, but the lack of liquidity between the prices makes it so. Notice how these levels act as strong levels of support and resistance. We can see there is little support below the gap, until the prior support where we buy.

Gaps are risky—due to low liquidity and high volatility—but if properly traded, they offer opportunities for quick profits. This will give you an idea of where different open trades stand. If you see high-volume resistance preventing a gap from being filled, then double-check the premise of your trade and consider not trading it if you are not completely certain it is correct.

Second, be sure the rally is. Irrational exuberance is not necessarily immediately corrected by the market. Sometimes stocks can rise for years at extremely high valuations and trade high on rumors, without a correction. Be sure to wait for declining and negative volume before taking a position. Last, always be sure to use a stop-loss when trading. Technical Analysis Basic Education. Advanced Technical Analysis Concepts. Your Money. Personal Finance.

Your Practice. Popular Courses. Trading Strategies Beginner Trading Strategies. Table of Contents Expand. Gap Basics. To Fill or Not to Fill. How to Play the Gaps. Gap Trading Example.

The Bottom Line. Gaps can be classified into four groups:. Breakaway gaps occur at the end of a price pattern and signal the beginning of a new trend. Exhaustion gaps occur near the end of a price pattern and signal a final attempt to hit new highs or lows.

Common gaps cannot be placed in a price pattern — they simply represent an area where the price has gapped. Continuation gapsalso known as runaway gaps, occur in the middle of a price pattern and signal a rush of buyers or sellers who share a common belief in the underlying stock’s future direction. Irrational exuberance : The initial spike may have been overly optimistic or pessimistic, therefore inviting a correction.

Technical resistance : When a price moves up or down sharply, it doesn’t leave behind any support or resistance. Here are the key things you will want to remember when trading gaps:.

Once a stock has started to fill the gap, it will rarely stop, because there is often no immediate support or resistance. Exhaustion make money on gap up stocks and continuation gaps predict the price moving in two different directions — be sure you correctly classify the gap you are going to play. Be sure to watch the volume. High volume should be present in breakaway gaps, while low volume should occur in exhaustion gaps.

Key Takeaways Gaps are spaces on a chart that emerge when the price of the financial instrument significantly changes with little or no trading in-between. Gaps occur unexpectedly as the perceived value of the investment changes, due to underlying fundamental or technical factors.

Gaps are classified as breakaway, exhaustion, common, or continuation, based on when they occur in a price pattern and what they signal. The trade must always be in the overall direction of the price check hourly charts. The currency must gap significantly above or below a key resistance level on the minute charts. The price must retrace to the original resistance level. This will indicate the gap has been filled, and the price has returned to prior resistance turned support. There must be a candle signifying a continuation of the price in the direction of the gap.

This will help ensure the support will remain intact. Let’s look at an example of this system in action:. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links.

Breakaway Gap Definition A breakaway gap is a price gap through resistance or support. It is usually accompanied by high volume and occurs early in a trend. Common Gap Common gap is a price gap found on a price chart for an asset. These gaps are brought about by normal market forces and are very common. Exhaustion Gap Definition An exhaustion gap is a gap that occurs after a rapid rise in a stock’s price begins to tail off.

Runaway Gap Definition A runaway gap, typically seen on charts, occurs when trading activity skips sequential price points, usually driven by intense investor. Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal.

Crypto Exchange Upbit’s Operator Eyes Blockchain in OTC Securities Trading https://t.co/2QcqfbyTtM pic.twitter.com/3m39CURJ7Z

— TheCryptoShop (@TheCryptoShopUK) October 18, 2019

Give it a try and see how it feels to you. Day traders should watch for. A tight trailing stop works well in this situation. This was the dangerous part in that I honestly believed each stock stcoks perform like this on every buy. First, I watch dumpers at the end of the day for buying action in the last five minutes of the market, sometimes buying in the last few seconds.

Comments

Post a Comment