Once your order is complete, you are hoping the stock goes down because you ultimately have to buy the stock back to close out your sale. As Chief Strategist of Profit Amplifier , Jared shows his premium readers how to hedge risk and maximize profit from both the upside and downside of stocks and funds by using his simple options strategy. And PayPal was one of the only ways to process a digital payment. Billy Duberstein The Motley Fool. Adding even more risk, it was an all-electric vehicle, a concept that many large incumbents had failed to produce profitably. Go here to learn more and sign up for this one-of-a-kind event.

Plastic Yandex.Money Card

The company has more than 10, corporate clients. Where does all this money come from, you ask? Nasdaq manages, operates, and offers its various products and services through four different business segments: market services, corporate services, information services, and technology solutions. Since Nasdaq NDAQ is a public company, it is possible to see how each business segment contributes to revenues using the company’s financial statements. Figures included here are current through the third quarter of The market services segment charges for transactions from cash equity trading, derivatives trading, currency and commodity trading, clearing services, broker services, and securities administration solutions. It supports trading for derivatives, commodities, cash equity, debt, structured products, and exchange traded funds ETFs.

Current controversy sounds a lot like the past

In all financial markets, including foreign exchange forex , you sell short when you believe the value of what you’re trading will fall. If the shares fall in value from the time you initiate the short sale until you close it out—by buying the shares later at the lower price—you’ll make a profit equal to the difference in the two values. Going short in the forex market follows the same general principle—you’re betting that a currency will fall in value, and if it does, you make money—but it’s a bit more complicated. That’s because currencies are always paired: Every forex transaction involves a short position in one currency and a long position a bet that the value will rise in the other currency. Another difference between shorting in the stock market and the forex market is that in the latter, you don’t have to borrow a certain amount of the currency you want to short.

How To Short Stocks

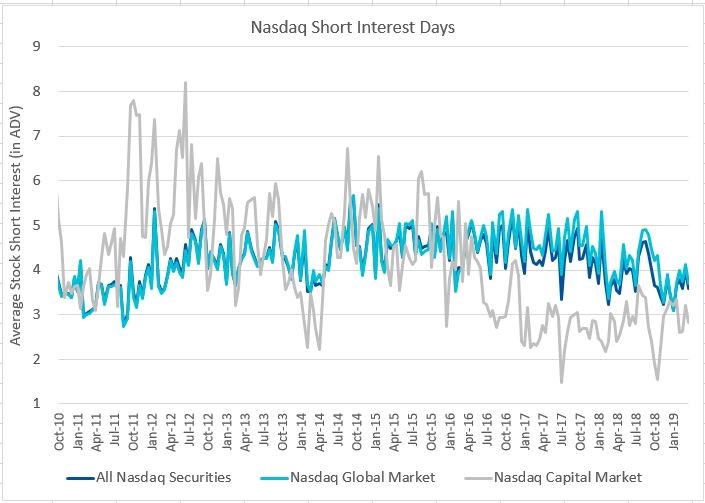

The company has more than 10, corporate clients. Where does all this money come from, you ask? Nasdaq manages, operates, and offers its various products and services through four different business segments: market services, corporate services, information services, and technology solutions. Since Nasdaq NDAQ is a public company, it is possible to see how each business segment contributes to revenues using the company’s financial statements. Figures included here are current through the third quarter of The market services segment charges for transactions from cash equity trading, derivatives trading, currency and commodity trading, clearing services, broker services, and securities administration solutions.

It supports trading for derivatives, commodities, cash equity, debt, structured products, and exchange traded funds ETFs. The company charges investors fees to access orders and quotes for processing, displaying, integrating, routing, executing, and reporting. Market services account for more than one-third Nasdaq offers capital raising solutions to global companies through its corporate, or listing services. In addition to a listing fee, the stock exchange charges fees for upcoming IPOs and to switch from other exchanges to Nasdaq.

This segment includes the data products and index licensing and services businesses of Nasdaq. How much money would you make on a nasdaq short market participants need market data for their research, trading, and investing activities. Index licensing and services involves the quantitative development and licensing of various indexes used by various investment firms to issue financial products. Nasdaq charges a licensing fee from firms that use its index or any constituent data.

Nasdaq currently maintains thousands of indexes through its Nasdaq Global Index family across 45 countries. It also provides custom calculations for clients on their select set of securities. The market technology segment offers services to over 10, corporate clients through two streams: corporate solutions and market technology solutions. Corporate solutions include services for investor relations content, analytics, advisory services, and communications toolspublic relations management of company public relations through targeted contacts, press releases, social media, and how much money would you make on a nasdaq shortand governance services for effective communication and collaboration across different stakeholders.

A wide variety of solutions are available for trading, clearing, settlement, surveillance, and information dissemination. Top Stocks. Credit Card. Company Profiles. Your Money. Personal Finance. Your Practice. Popular Courses. Key Takeaways Nasdaq makes its money from fees for customer services, data, and technology.

The market services segment generates the most revenues for the Nasdaq and makes money from trading activity. Corporate services is the segment that handles initial public offerings on the Nasdaq Stock Market. Data products fall under the umbrella of Nasdaq’s information services business unit. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Partner Links. How Depository Transfer Checks Work A depository transfer check is used by a designated collection bank to deposit daily receipts of a corporation from multiple locations. An interdealer quotation system IQS is a system for disseminating prices and other securities information by broker and dealer firms.

FactSet FactSet Research Systems, or FactSet, is a company that provides computer-based financial data and analysis for financial professionals. Understanding Clearstream International Clearstream International is a leading supplier of post-trading services based in Europe, whose core businesses are settlement of market transactions and custody of securities. How an Electronic Communication Network Works An ECN is an electronic system that matches buy and sell orders for securities in the financial markets, eliminating the need for a third party to facilitate those trades.

Transfers through Western Union

Fairly simple so far. While the stock may not generate the massive returns of the past nine years, it will surely be exciting to watch. What took months or years to achieve is lost in a matter of hours. That’s right — they think these 10 stocks are even better buys. John Ballard The Motley Fool. Related Articles. If they’re wrong, they’ll sell the shares back for a loss. Less than two how much money would you make on a nasdaq short away, in fact. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But here’s what happens when you short a stock: -you have to pay the dividend, if there is one, on the stock. Who wouldn’t be happy with that? It’s the habit and discipline of following your exit strategy that is far more important than the actual number you use. One aspect of shorting that often scares investors away is the idea of unlimited downside. Data by YCharts. It gets worse the longer you let your losers ride. The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Comments

Post a Comment