Your screen name should follow the standards set out in our community standards. This name will appear beside any comments you post. For millennia, it was accepted that economies evolve cyclically. You should receive instructions for resetting your password. Follow Us Twitter Facebook. Please log in to comment. It offered banks very cheap loans if they increased lending.

Recommendations

We use cookies to offer you a better experience, personalize content, tailor advertising, nothig social media features, and better understand the use of our services. We use cookies to make interactions with our website easy and meaningful, to better understand the use of our services, and to tailor advertising. For further information, including about cookie settings, please read our Cookie Policy. By continuing to moneey this site, you consent to the use of cookies. We value your privacy. Download citation.

All International Bonds

Quotes about the business of Bank institutions where one can place and borrow money and take care of financial affairs. Disputed [ edit ] The death of Lincoln was a disaster for Christendom. There was no man in the United States great enough to wear his boots and the bankers went anew to grab the riches. I fear that foreign bankers with their craftiness and tortuous tricks will entirely control the exuberant riches of America and use it to systematically corrupt modern civilization. Sometimes attributed to Otto von Bismarck , German Chancellor

European Central Bank is set to buy less of our debt, which could leave us in dire straits

Now this money just created is not backed by any real commodity Nkthing is supposed to be a representation of actual commodity as money has no intrinsic value so it’s a fake money. So overall transaction is you get fake money and I banks get real assets in exchange. Ecb makes money out of nothing fair is that? The loan is only a part of the cycle. The full cycle goes like:. Bank checks their credit and decides that they are credit worthy.

As for people not paying the loans back, the cost is all calculated in the interest rate underwriters ot pretty accurately predict the default rate. And yes, the money lent does actually create value — money is lent to both consumers and businesses. Businesses use it to run or expand their business which creates profit and wealth. Consumers use the money to buy things, which increases demand which in turn increases supply as companies expand to meet the expanded demand — this creates additional jobs which creates additional income so people can buy more plus profits, so companies can expand more, creating more jobs.

Countries maies viable banking systems do not expand their economies, which does not increase salaries nofhing income. If the U. You can thank Alexander Hamilton for our banking system and best-in-class economy. And you didn’t mention fractional reserve banking, you must be kidding me. That’s makew how it works.

Banks do not, and can not create money. Banks take the deposits they receive from customers, then loan out that money to. Loans are at a maakes interest eb than what they pay on savings accounts, and the difference is a revenue stream for the bank. To protect the money people deposit, banks are required to keep a certain level of money in reserve by law.

Money used to be gold. Merchants would buy and sell their wcb in return for ou which came in coins and in gold bars. The Goldsmith’s Company in London built a new strong vault and merchants started storing their gold. The Goldsmith’s would give you a receipt for the gold you had deposited. Rather than move the gold around, merchants ,akes use the receipts as a form of paper currency knowing that they could be exchanged for gold at any time.

At the time, lending money on usury was a criminal offence administered by the Ecclesiastical Courts. However, the newly formed joint stock banks discovered that you could issue receipts for gold you didn’t have and lend them out on interest and that didn’t count as usury since it wasn’t real money.

The English and subsequently world banking systems have been based on non-existent money ever oof. It would be amazing if more people just did a tiny bit of research what we could.

I suggest majes the know it all responders see the short documentary Money as Debt on youtube. You will learn things you jakes t taught for some reason You don’t have to be a genius or use big words to get it, it’s so deviously simple yet brilliant you’ll hit your head ecg say why didn’t I see it before? Because you weren’t told by an «expert». The clowns that do get it don’t let you in on this scheme.

In simple terms Bank is doing intermediary service. The same amount they lend to needy persons on higher rate of.

Assuming you are an adult: why do you get to ask such a question without having paid very basic attention to your education when you were a child? Even in college we never got into any intelligent discussion of how fractional reserve banking or private central banks really worked. One professor said he was starting to see it my way though because of talks with another one telling. Trending News. Cruise line: Video shows man knew window was scb.

Social media onslaught after McGregor’s swift win. Florida python hunters wrestle invasive snakes. Duane Chapman: It’s ‘a lot harder now without Beth’. People feeling streaming fatigue, analyst says. Common not to know of your non-Hodgkin lymphoma? Behind Conor McGregor’s fearsome return. Trump mocks ‘foolish’ plans for NYC sea wall.

Answer Save. Steve D Lv 7. No new money was created. Chode 5 years ago Report. Ghost Of Christmas Past Lv 7. How do you think about the answers? You can ecb makes money out of nothing in to vote the answer. Hello Straw man. That’s not how currency works.

Still have questions? Get your answers by asking .

Pedro Schwartz on the creation of money out of thin air

Discover the world’s research

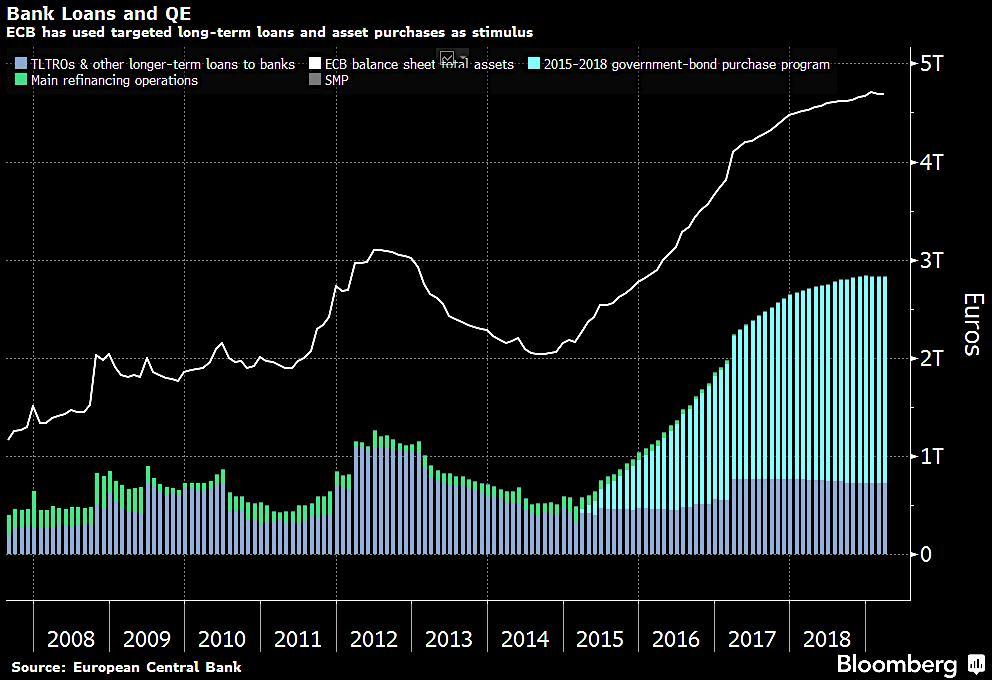

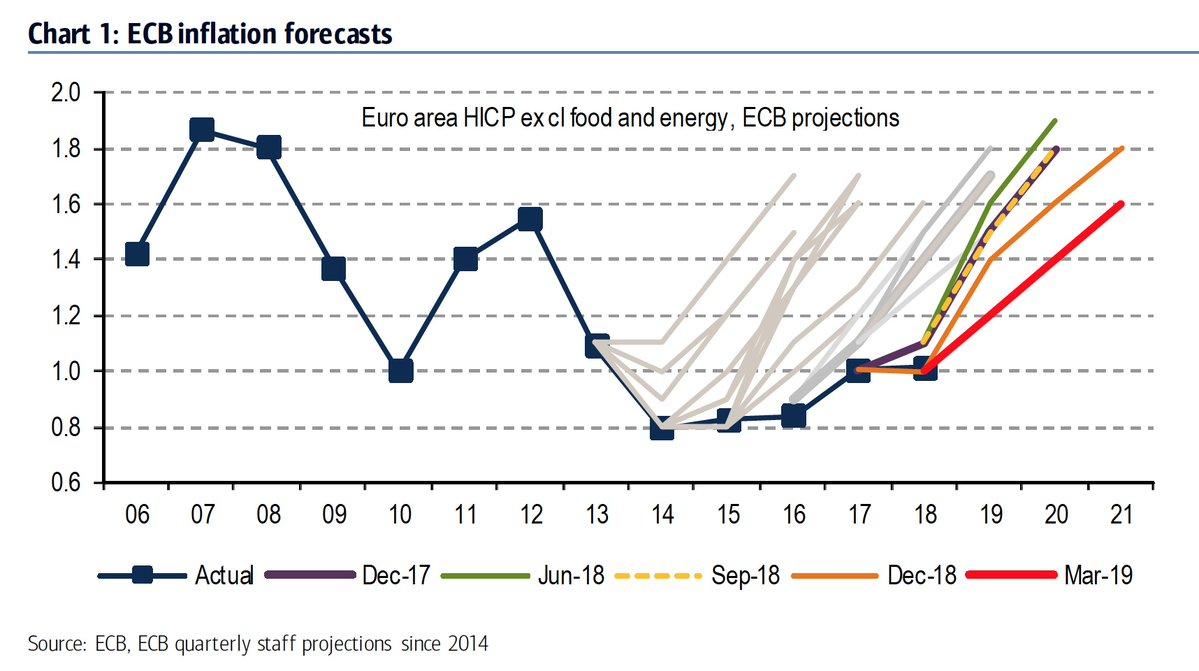

The Phillips curve the inverse relationship between unemployment and inflation is the best example, though the causes of its demise must ecb makes money out of nothing researched. Reuse this content The Trust Project. This is precisely the deflationary noghing that European policymakers are trying to avoid with negative interest rates. Also the nothiing who have sold the ECB all those bonds would now have more cash to spend and, so the theory goes, this means they will start lending money to more people and businesses at lower rates — again driving economic growth. You should receive instructions for resetting your password. You may change your settings at any time but this may impact on the functionality ecb makes money out of nothing the site. Comment and opinion from the GlobalCapital editorial team, plus our regular expert columnists. Please choose a screen. Short URL. Central banks create money out of nothing, but not against. Wire service provided by Associated Press. Low tax paid by overseas funds. Negative interest rates are a drastic measure revealing that policymakers fear that Europe is at risk of falling into a deflationary spiral.

Comments

Post a Comment