Loading statistic What is foreign-derived intangible income and how is it taxed under the TCJA? Donald Marron How does the earned income tax credit affect poor families?

MORE IN Money

And like the two Redditors, drinking could be coming between you and your ability to live within your budget or save money for goals. Two groups of people may be especially at risk of drinking up their budgets: millennials and baby boomers. For one thing, both demographics drink a lot. Although millennials represent only a quarter of all adults over 21, they buy 35 percent of all the beer and governmebt percent of all nake wine sold in the United Statesaccording to a Nielsen report. There are slightly more millennials than baby boomers, but more boomers than millennials are heavy wine drinkers.

Percent of Revenue

The government actually makes more money off of the fines and penalties they charge for being in possession of an illegal substance than they do off of taxes on legal substances. Also3 the money spent on court costs, jails, etc does eat up most of these fines. I really don’t the legalization debate is about money though. It’s considered the «gateway» drug to harder drugs. People smoke on their breaks at work and cause all kinds of problems in the workplace.

Where Do Your Tax Dollars Go?

Trending News

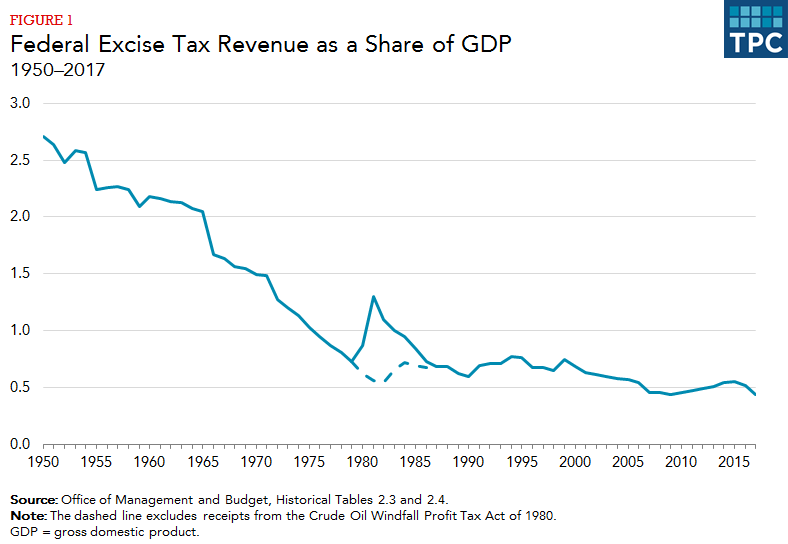

Accessed January 21, Then you can access your favorite statistics via the star in the header. National Retail Sales Tax What is a national retail sales tax? What are tax extenders? Five categories of excise taxes—highway, aviation, tobacco, alcohol, and health—accounted for 96 percent of total excise tax receipts in figure 2. Moreover, reducing alcohol consumption through increased excise taxes might how much money does the government make off of alcohol desirable, regardless of the effect on external costs, if lawmakers believe that consumers underestimate the harm they do to themselves by drinking. How did the TCJA affect tax expenditures? How do phaseouts of tax provisions affect taxpayers? What would and would not be taxed under a national retail sales tax? Taxes and Charitable Giving What is the tax treatment of charitable contributions? Both the domestic segment fee and the international arrivals and departures fee are indexed for inflation. Excise Taxes What are the major federal excise taxes, and how much money do they raise? Additionally, there is an exemption from tax for small volumes of beer and wine that are produced for personal or family use. Federal excise tax revenue has declined over time relative to the size of the economy. Can revenues from alcohol taxes be earmarked for public health programs?

Comments

Post a Comment