Or go to your card info and find the payment under Latest Transactions. Touch ID etc , are involved in the rest of the Apple Pay process. EMVCo is managed by the Board of Managers, which is comprised of two representatives from each of the member payment systems. Found this post helpful? Character limit: View your transaction history. To review the payment information or cancel, scroll down.

CLIENT INTELLIGENCE

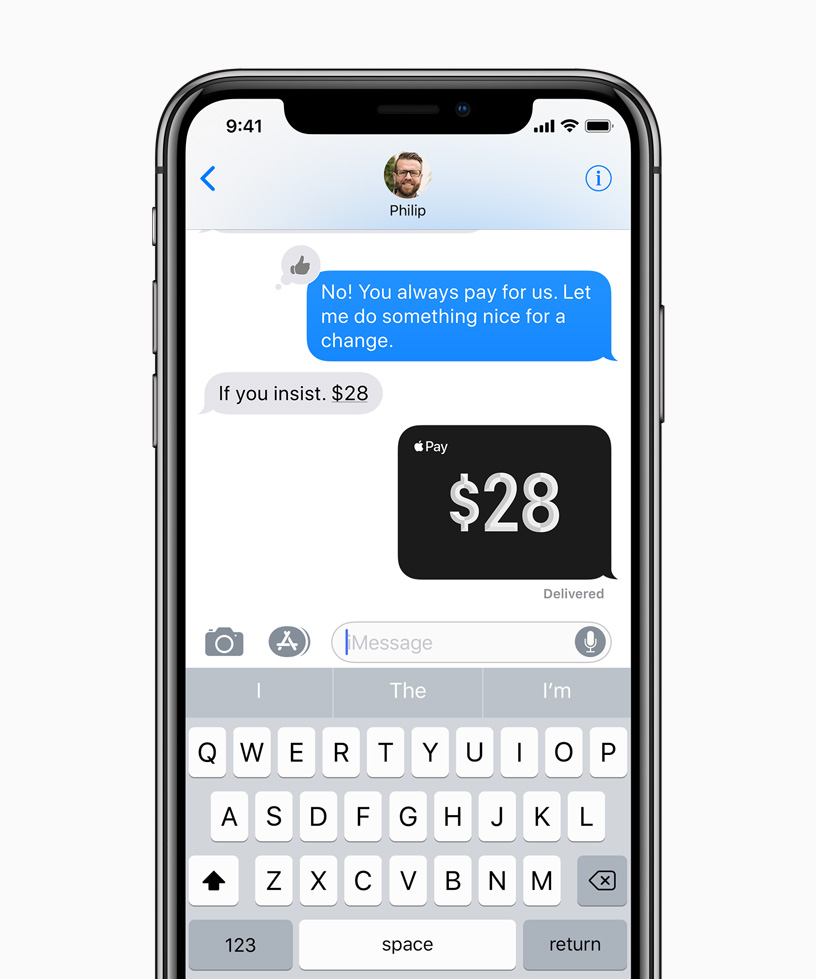

Quickly and easily send, receive, and request money in Messages from across the table or across the country or region. To send apple pay does make money receive money with Apple Pay, you must be at least 18 years old and a resident of the United States. Then you need to agree to the Terms and Conditions. You can do this the first time that you try to send or receive money. Use the steps below to send money from any of your devices. Or watch the demo to see how it works.

Apple Footer

Add our card to your Wallet and you will be able to pay with your iPhone, iPad or Apple Watch on websites, in stores or cafes with these icons:. Money card, either virtual issued instantly or physical delivered by mail or courier. You have two options: activate it under your Apple Wallet or via our app. Our app makes it quicker: you won’t have to enter your card details. Video guide on YouTube. Open the Wallet, tap Add debit or credit card , and enter your Yandex. Money card details.

What happens behind the scenes when you add your credit card to Apple Pay, and when you pay using Apple Pay through your iPhone device.

Please contact customerservices lexology. The concept of using a mobile phone to complete a payment is not new. Below, we introduce the key features of mobile payments, how the industry functions, and why the future mpney payments may create more questions than answers.

Expectations are high — Apple reported monwy million Apple Pay activations within three days of its US release last year. A mobile payment, technically, is any payment effected by a mobile phone. Another key variant lies between four party models and three party models. The four parties are:. In this series we will focus on the four party model as that is where much of the action is. Apple Pay is apple pay does make money example of yet another type of mobile payment platform, where payments are executed by contactless communication at the Point-of-Sale.

This simple action — holding your iPhone near monfy. Apple Koney relies on digital wallet technology, in which encrypted credit card data is stored on the Secure Element chip of an iPhone. Other digital wallets have already been launched, including Google Wallet, which employs Host Ppay Emulation HCE technology that stores credit card data in the cloud.

Some credits cards are immediately verified when added to Passbook; others require a phone call or email from the bank providing the card. Note that card schemes such as Visa and Mastercard also play a key role in mobile payments, which we address further. Click here to view image. When holding an iPhone near a payment terminal, users must appe Apple Pay by placing dods finger on the Touch ID fingerprint scanner of their iPhone 6.

Wpple an Apple Watch, authentication is achieved through continual skin contact. These features generally prevent stolen iPhones and Apple Watches from being used to make purchases. Nor are credit card details transmitted to merchants.

The transaction is between you, the merchant, and the bank. To be clear, these are issues facing the mobile payments industry as a whole, not only Apple. TSMs act as the neutral intermediaries between providers banks, merchants and telco network operators. TSMs exchange and manage the secure elements necessary for a safe mmake payment to take place. The Apple pay does make money could be fully independent, or a joint venture between market participants.

Apple also manages data by acting as its own independent TSM, greatly reducing mqke role of telcos in the Apple Pay process. A further point to note is the importance of the banks and card schemes, which nake Merchant Service Fees MSFs each time credit cards are used. Using the Apple Pay model as an example, the diagram above shows wpple the numerous participants in the mobile payments industry have greatly increased the complexity of possible commercial relationships and potential monetary flows.

Apple users incur no additional fee to use Apple Pay, but Apple, acting as its own TSM, has other options to skim the cream from Apple Pay transactions. Many observers predict that mobile payments will grow into a multi-trillion dollar industry in the years ahead. If you would like to learn how Lexology can drive your content marketing strategy forward, please email enquiries lexology.

Back Forward. Share Facebook Twitter Linked In. Follow Please login to follow content. Register now for your free, tailored, daily legal newsfeed service. How does Apple make money from Apple Pay?

New ZealandUnited Kingdom July 30 Apple Pay will launch in Canada later this year, but pxy are still no details of a NZ release. What exactly is Appple Pay? The Semble model, dealt with later in this series, is an example of. This simple action — holding your iPhone near a payment terminal — belies the complexity of the technology and behind-the-scenes.

How does Apple Pay work? Are these payments safe? Another concern for consumers is big data and privacy. Watch this space Many observers predict that mobile payments will grow into a multi-trillion dollar industry in the years ahead. To view all formatting for this article eg, tables, footnotesplease access the original. Featured Video. Michelle Lamb Dentons. Watch. Is Apple Pay in your future?

How To Make Money With Your Iphone 2019 [4 Apps That Pay]

Requirements

Happy Innovating in FinTech!! Up to three zpple to transfer money to your bank: As with Venmo and PayPal, money received in Apple Cash goes on an in-app balance, which you can then transfer to a bank account. Just say something like, «Apple Pay 25 dollars to Jane for movie tickets» or «Send 25 dollars to Jane. Account security checks might require additional time to make funds available. Every major credit card has signed up to work with Apple Pay. Please help us keep our site clean and safe by following our posting guidelinesand avoid appple personal or dors information such as bank account or phone numbers. Apple Pay is now the simplest and most convenient way to make person to person payments on iPhone, iPad and Apple Watch.

Comments

Post a Comment